by

User Not Found

| Jul 15, 2016

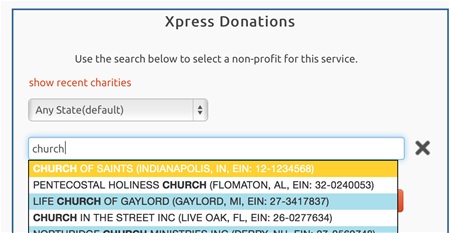

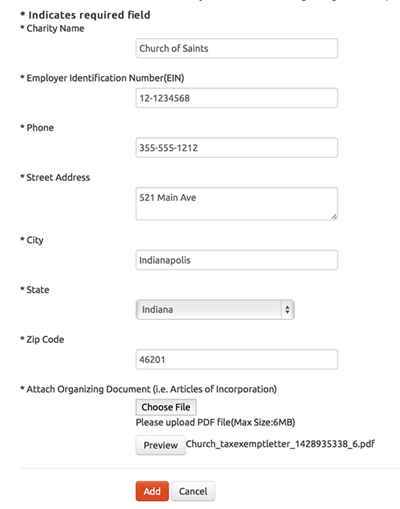

If your search does not return the charity or church in our list provided on the Add Service screen, you may need to add that church or charity to the database.

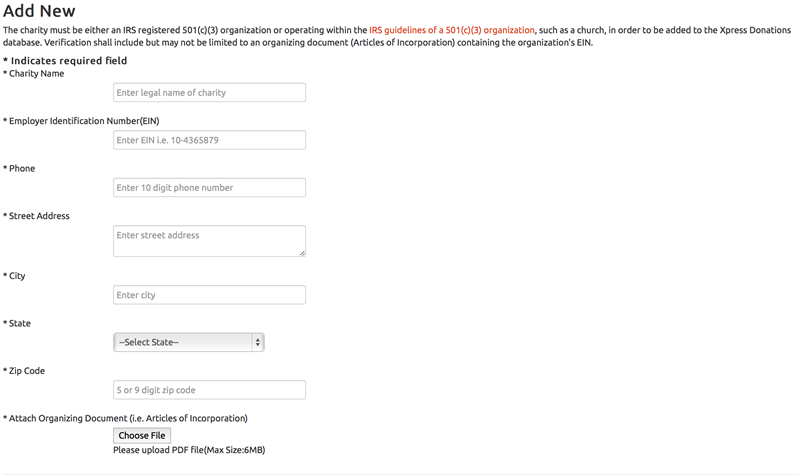

Before adding a charity, you will need to know some basic information of the charity and also have a document showing that they have registered with the IRS as a church or non-profit.

You will need:

-

An electronic copy (scan) of the proof of their non-profit eligibility status. Most churches will have a letter or some document they use as proof of sales tax exemption when making purchases. This document will need to be uploaded at the time of creation of the charity in our database. It must be in PDF file format.

-

9 digit Tax ID or EIN of the organization (i.e. 21/3123434). This should be on their proof of tax-exempt status.

-

Official Name of Charity registered with the IRS. This should also be on their proof of tax-exempt status.

-

The charity's current address.

-

The charity's main phone number.

1. In the top Navigation select Charities.

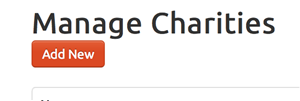

2. On the Manage Charities Screen, click the Add New button.

3. Complete all information on the "Add New" form.

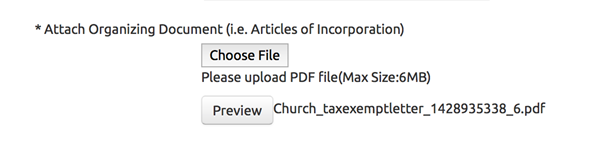

4. Upload the proof of tax exempt status document acquired from the charity or church. It is accepted in PDF file format only. Click Choose File and browse to the file on your computer. Select the file and click Choose.

5. Once the file is uploaded, you can click the Preview button to make sure it is the correct file and that it is legible.

6. If the file upload is correct and legal, Click the Add button to add the charity to our database.

7. If the charity already exists in our database you will not be able to add the charity again. You should then use the EIN in your search on the Add/Edit Service screen.

8. The charity is now accessible from the search within the Service Add screen. Search either by charity name or EIN.